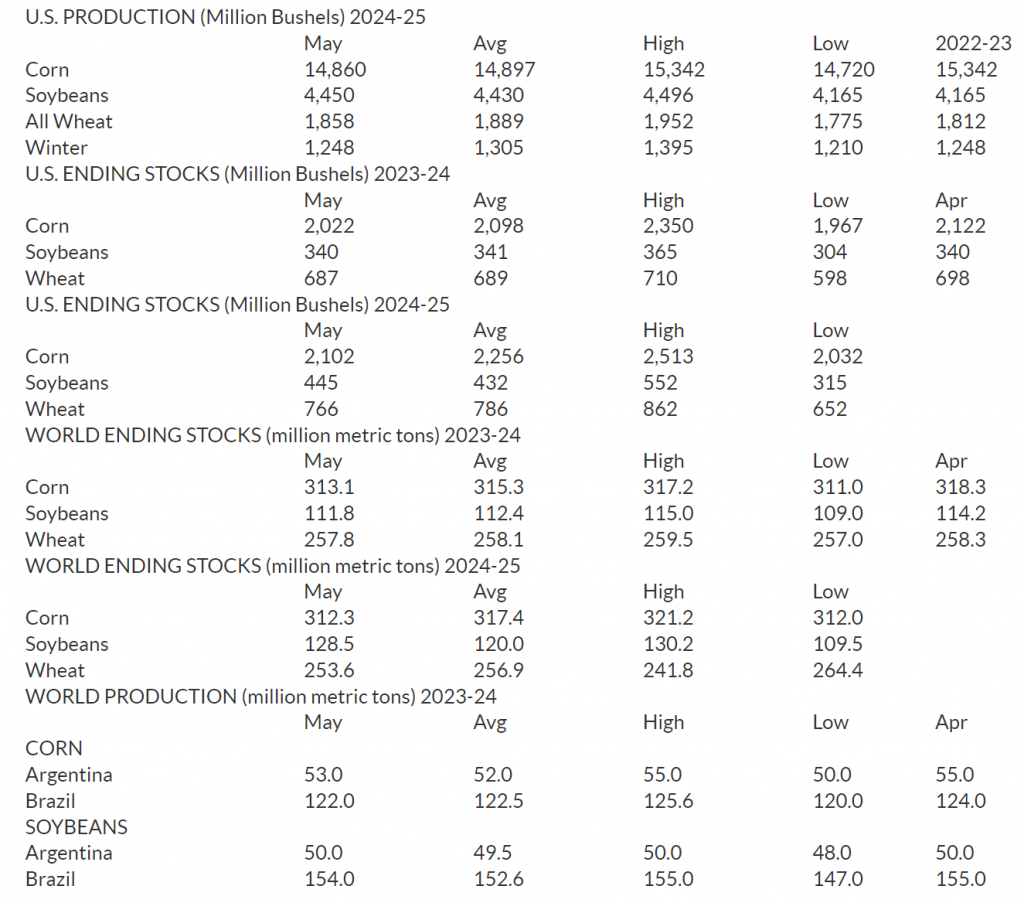

USDA on Friday released the May World Agricultural Supply and Demand Estimates (WASDE) report, which includes the first detailed forecast for the 2024-25 corn and soybean crops. USDA forecasts that farmers this spring will plant what will become a 14.86-billion-bushel corn crop and a 4.45-billion-bushel soybean crop.

Farm Director KC Sheperd met with Allendale’s Rich Nelson to discuss the latest WASDE report and its implications for the agricultural market.

Nelson noted that the report indicated slightly better news in some areas, particularly for corn, due to lower old crop balance sheets and increased demand for ethanol and exports. However, soybean stocks remained unchanged, and new crop projections were larger than expected, offering some upside for corn. Rich also emphasized the need for a risk-on summer premium in the market to help curtail supply numbers, highlighting that dryness was forecasted for the West in the coming months.

As for the Wheat Discussion, Nelson said the argument would be slightly positive, “We saw these numbers for all crops lower just a minimal amount here today now 688 million bushels. They did give us a discussion here for both all wheat production and winter wheat breakdowns. And between all that, they suggested that stocks increase to 766. The focus was not on the balance sheet. But the focus was that they now have the lowest estimate for the Russian wheat crop of anybody, and they’re starting out with some pretty tight numbers for Australia as well.”

Nelson said that Winter Wheat Production for Oklahoma is not as Dramatic as it could be: “Oklahoma and the prior two years had been running about 69 million bushels for a winter wheat production. Today’s numbers post them at 96. It is an increase but keep in mind just this past week at one of Oklahoma wheat tours final meeting a lot of the trade participants were looking for 105 or even 115. So it is an increase. Yes, but it’s not as dramatic as it could have been.”

When looking at the Cotton Numbers, Nelson said the cotton balance sheet has been getting a lot of trade focus, “Keep in mind we went from 2022, which had 4.3 million bales for stocks, down to 2.4. Last year for those over now for this new crop discussion with only minimal changes in implanting expected versus last year. USDA is coming up with an ending stock number moving up to 3.7, so a return to more normal yields would put us in the middle of this tightness argument from last year. Which is very tight, and the year before, which was not too bad. So puts right in the middle of those prior two years.”

Lastly, Rich suggested that livestock numbers would continue to be tight, with 2024 beef production expected to be 1.4% smaller than 2023, and that cotton stocks would also likely increase.

USDA estimated the 2024-25 corn yield will be 181 bushels per acre. The soybean crop is also projected at 52 bpa.

USDA also released its May Crop Production report on Friday.

Friday’s U.S. ending stocks estimates were slightly bullish for corn and neutral for soybeans and wheat, World ending stocks estimates from USDA were bullish for corn, neutral for soybeans and slightly bullish for wheat.

You can also view the full reports here:

— Crop Production: https://www.nass.usda.gov/…

— World Agricultural Supply and Demand Estimates (WASDE): http://www.usda.gov/…