Tue, 04 Oct 2022 11:38:29 CDT

The National Sorghum Foundation (NSF) and BASF are now accepting applications for a joint scholarship that will be awarded January 2023, providing $2,500 for tuition for the 2022-2023 academic year.

&ld…

Oct 04

Tue, 04 Oct 2022 11:38:29 CDT

The National Sorghum Foundation (NSF) and BASF are now accepting applications for a joint scholarship that will be awarded January 2023, providing $2,500 for tuition for the 2022-2023 academic year.

&ld…

Oct 04

Tue, 04 Oct 2022 11:09:04 CDT

Below is an editorial by Joe Parker Jr., the past president of Texas & Southwestern Cattle Raisers Association and ranches in Clay County.

Try as you might, you cannot raise cattle without land. They ei…

Oct 04

Tue, 04 Oct 2022 09:47:45 CDT

ASAA Cowboy Tailgate

Join us this Saturday, October 8

beginning at 10:30 a.m. until kickoff at 2:30 p.m.

We invite you to join the OSU Animal Science Alumni Association for the annual Cowboy T…

Oct 04

Tue, 04 Oct 2022 09:15:36 CDT

The USDA recently proposed new competition and market integrity rules under the Packers and Stockyards Act. Collectively referred to by the agriculture industry as the GIPSA rules, Senior Farm and Ranch Broadcaster, Ron Hays, is featuring comments from National Cattlemen’s Beef Association CEO Colin Woodall talking about these regulations.

Before he was CEO of NCBA, Woodall was a long-time lobbyist for NCBA in their Washington D.C. office. One of the things he worked on during the Obama years was the GIPSA rules. These rules have resurfaced again from the Biden administration’s most recent ideas of coming up with fairness for livestock markets.

“This, once again, is USDA coming in and trying to tell cattle producers how they can and cannot market cattle,” Woodall said. “What is most concerning is just how broad this seems to be. It is very broad in scope, a little light in details, and anytime you have anything from a federal agency that is so broad in scope and light in details, you have to get worried because it goes back to what we have spent the past two years talking about and that is where is the appropriate role of government in cattle markets.”

While it is ideal for government to stay out of cattle markets, Woodall said when it comes to the Packers and Stockyards Act as it exists today, he believes it does a good job, but it just needs to be fully enforced instead of adding more layers.

“If we do that, then a lot of the issues that are popping up in this proposed rule are going to be ones that just aren’t as important anymore,” Woodall said.

Woodall also talked about the SEC’s (Securities and Exchange Commission) effort to require reporting of greenhouse gas emissions. He said the SEC’s role is not to regulate greenhouse gasses.

“Their role is to regulate those publicly traded companies and the financial transactions between them,” Woodall said. “It is not meant to regulate greenhouse gasses. They don’t have the jurisdiction, and they don’t have the expertise.”

Attempting to regulate greenhouse gasses, Woodall said, is an agenda-driven action to try to enforce more greenhouse gas regulations on all segments of the supply chain.

“With this, especially if it covers scope three, it means that all of our greenhouse gas emissions as cattle producers are going to have to be passed up the chain as we sell our cattle,” Woodall said. “SEC needs to focus on Wall Street, not on Main Street because their jurisdiction, their area of expertise is on financial markets, it’s not on greenhouse gasses.”

NCBA is working hard to make sure that Gary Gensler, the chair of SEC, understands that this does not need to go any further.

“We have quite a few members on Capital Hill who have been very willing to step up and help us fight back,” Woodall said.

One of those helping in the fight is Congressman Frank Lucas, who recently introduced the Protect Farmers from the SEC Act. Over 100 Co-sponsors signed with Lucas to get the SEC to take a step back from cattle producers.

Click the LISTEN BAR below to listen to Colin Woodall talking about the SEC’s attempts to regulate greenhouse gasses on all segments of the supply chain.

The Beef Buzz is a regular feature heard on radio stations around the region on the Radio Oklahoma Network and is a regular audio feature found on this website as well. Click on the LISTEN BAR below for today’s show and check out our archives for older Beef Buzz shows covering the gamut of the beef cattle industry today.

NCBA’s Colin Woodall Talks GIPSA Rules

Oct 04

Tue, 04 Oct 2022 08:58:36 CDT

Click here to listen to audio

Farm Director, KC Sheperd, got the chance to visit with the President of the American Society of Agricultural Consultants, Kyle Walker, and the Chair of Marketing and Promo…

Oct 04

Tue, 04 Oct 2022 12:07:51 CDT

The Purdue University/CME Group Ag Economy Barometer farmer sentiment index declined 5 points to a reading of 112 in September. The decline in farmer sentiment was primarily the result of producers’ weakened perception of current conditions, as the Current Conditions Index declined 9 points to 109. The Index of Future Expectations also weakened slightly, declining 3 points from a month earlier to a reading of 113. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted between September 19-23.

“Concerns about input costs and, in some cases, availability are key factors behind the relative weakness in this month’s farmer sentiment,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “However, a growing number of producers are also concerned about the impact of rising interest rates on their farm operations.”

Higher input costs remain the number one concern among survey respondents. In September, 44% of respondents chose “higher input costs” as their number one concern, while 23% chose “rising interest rates,” and 14% chose “availability of inputs.” When asked to look ahead to 2023, the largest share (38%) of producers expect input prices to rise from 1% to 9%, compared to 2022 prices. Meanwhile, nearly a fourth (24%) of producers expect input prices to rise from 10% to 19%, and 9% of survey respondents said they expect an input price rise of 20% or more.

The Farm Capital Investment Index declined to a record low of 31 in September, as producers continue to indicate now is not a “good time” to make large investments in their farming operations. To understand why they felt that way, a follow-up question was posed to farmers who reported now being a “bad time” to make large investments. For the third month in a row, producers overwhelmingly (46%) said it was due to increasing prices for farm machinery and new construction; however, 21% indicated that “rising interest rates” were a primary reason, up from 14% who cited interest rates back in August.

Despite that negative perspective, fewer producers plan to reduce their farm machinery purchases. Since peaking in March 2022 at 62%, the share of producers who plan to reduce their machinery purchases compared to a year earlier has been declining, dipping to 47% in September. Their plans for farm building purchases tell a similar story. Since the March 2022 high of 68%, producers who planned to reduce their building and grain bin purchases has fallen to 56% in September.

Producers’ perspective on farmland values continues to soften. This month the Short-Term Farmland Value Expectations Index fell 5 points to 123 and the Long-Term Farmland Value Expectations Index fell 7 points to 139. Compared to a year ago, the short-term index is down 21%, while the long-term index has fallen 12% over the same time frame. In a follow-up question posed to respondents who expect farmland values to rise over the next 5 years, non-farm investor demand (60%) remains their primary reason for the rise.

This month’s survey included a series of questions to understand producers’ cover crop usage. Nearly six out of 10 (57%) respondents said they currently plant cover crops on a portion of their farmland, while approximately one out of four producers said they have never planted a cover crop. Most producers who report planting cover crops say they only plant them on a portion of their farmland with half indicating they plant on 25% or less of their acreage. However, some farms report more intensive use of cover crops as nearly a fourth of respondents said they plant cover crops on over 50% of their farms’ acreage. A large share (40%) of producers who reported planting cover crops this month said they have been planting cover crops for 5 years or less, while 28% of respondents said they have been planting cover crops for more than 10 years. The reasons for planting cover crops vary, with 37% citing “improve soil health” and 33% citing “improve erosion control” as the primary motivators. Just 5% of cover crop users indicated “carbon sequestration” as a motivation for planting cover crops.

Read the full Ag Economy Barometer report at https://purdue.ag/agbarometer. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results, available at https://purdue.ag/barometervideo. For more information, check out the Purdue Commercial AgCast podcast available at https://purdue.ag/agcast, which includes a detailed breakdown of each month’s barometer, in addition to a discussion of recent agricultural news that affects farmers.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

Oct 04

Tue, 04 Oct 2022 08:07:06 CDT

Weekly, Mark Johnson, extension beef cattle breeding specialist at Oklahoma State University, offers his expertise in cattle breeding. This is a part of the weekly series known as the "Cow-Calf Corner&q…

Oct 04

Tue, 04 Oct 2022 08:02:58 CDT

Note: This article first appeared in Hoard’s Dairyman Intel.

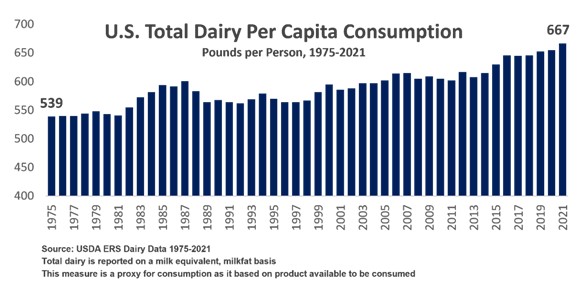

With this year’s USDA report on per-capita U.S. dairy consumption, the industry has finally moved past the 1960s. In terms of favor with the American public, dairy has returned to 1959.

Sound strange?

It’s true.

The USDA’s annual report on per-capita U.S. dairy consumption released Friday, September 30, saw an emphatic rise in domestic dairy demand, going from 655 pounds per person in 2020 to 667 pounds per person last year. That’s a level of dairy popularity that surpasses 1960, when it was 659 pounds, and is approaching 1959’s consumer appeal of 672 pounds.

In other words, the last time Americans wanted as much dairy as they do today, Elvis was in the Army. And keep in mind, the 1959 population of the United States. then was only slightly more than half of what it is now. And exports, which now take up nearly 20% of domestic production, barely existed back in those days.

So, what does this say about the industry?

What it doesn’t say is that Americans are consuming dairy the same way now as they did then. Fluid milk has continued its slow decline, according to the USDA data. But cheese continues to rise – American-style cheese consumption reached another record last year. And butter – well, butter actually is returning to Eisenhower-era levels, so in that case, a “Back to the Future” comparison may be appropriate.

But even as the dairy product consumption mix shifts over time, the overall positive trajectory – the 2021 gain is the seventh in the past eight years – is clear, and impressive. Despite more and more competition from nondairy competitors . . . despite an increasingly demanding consumer . . . and despite disruptions that range from diet fads to pandemics . . . consumers continue to find dairy increasingly useful, preferable, and important. That’s a tribute to the hard work of dairy farmers and the entire industry. And it’s worth celebrating.

So put on your turntable some Buddy Holly, some Johnny Cash, maybe some Little Richard, or whatever else suits your taste as dairy celebrates. Maybe serve some cheese, some yogurt, or if you’re feeling really old-school, some whole milk – a bright spot in the fluid segment. Just stay away from playing any Chubby Checker. “The Twist” was a hit in 1960. And as dairy breaks historical barriers to reach ever-higher levels of popularity, that’s so last year.

Oct 04

Tue, 04 Oct 2022 08:00:38 CDT

By Alyssa Hardaway

A group of Oklahoma financial institutions are supporting the Oklahoma State University New Frontiers campaign to help build a new home for OSU Agriculture.

Armstrong Bank, es…

Oct 04

Tue, 04 Oct 2022 07:53:15 CDT

Ag in the Classroom is excited to announce the contest theme for 2023!

OKLAHOMA AGRICULTURE: OUR ROOTS RUN DEEP!

There are so many ways to think about this theme! Families, historical aspects of agr…