Agricultural News

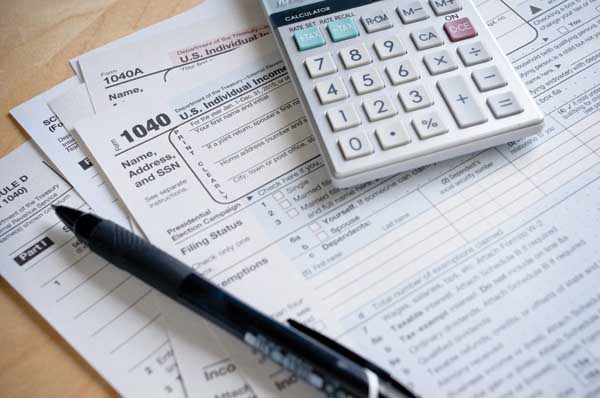

Farmers Push for Comprehensive Tax Reform that Supports the Preservation of Agricultural Lifestyles

Wed, 19 Jul 2017 16:00:53 CDT

Tax policies to support and preserve agriculture are essential to every farmer and rancher in America, a group of Farm Bureau members in Washington, D.C., this week to meet with lawmakers say.

Tax policies to support and preserve agriculture are essential to every farmer and rancher in America, a group of Farm Bureau members in Washington, D.C., this week to meet with lawmakers say.

"Tax reform is critical for farmers and ranchers," said Isabella Chism, a corn and soybean farmer and Farm Bureau member from Indiana who is vice chair of the AFB Women's Leadership Committee. "Reform is absolutely necessary so we can pass our farms and ranches down to our sons and daughters."

Kalena Bruce, a Farm Bureau member from Missouri, said "Farming is very risky. There are several big unknowns, like the weather and markets. Congress can help farmers and ranchers with permanent tax reform that lowers the effective tax rate across the board for farmers and ranchers. For me, that means continuing cash accounting and the business interest expense deduction and allowing immediate expensing." Bruce, who operates a commercial beef ranch and u-pick berry patch, is also a certified public accountant and serves as chair of AFBF's Young Farmers & Ranchers Committee.

Andy Hill, a Farm Bureau member and farmer from Iowa who grows corn and soybeans and serves on AFBF's Budget and Economy Issue Advisory Committee, is especially concerned about the need for estate tax repeal and capital gains tax reform.

"Both of those have limited the options available-both to agriculture as a whole and to my family. I'm particularly concerned about capital gains taxes preventing my family from keeping our century farm," Hill said.

Farm Bureau is seeking tax reform that will help all types of farm and ranch businesses: sole-proprietors, partnerships, sub-S and C corporations. In addition, Farm Bureau supports replacing the current federal income tax with a fair and equitable tax system that encourages success, savings, investment and entrepreneurship. Learn more here.

Source - American Farm Bureau Federation

WebReadyTM Powered by WireReady® NSI

Top Agricultural News

More Headlines...