Agricultural News

Tax Rates on Horizontal and Vertical Well Equalized by Oklahoma Legislature

Thu, 22 May 2014 19:46:15 CDT

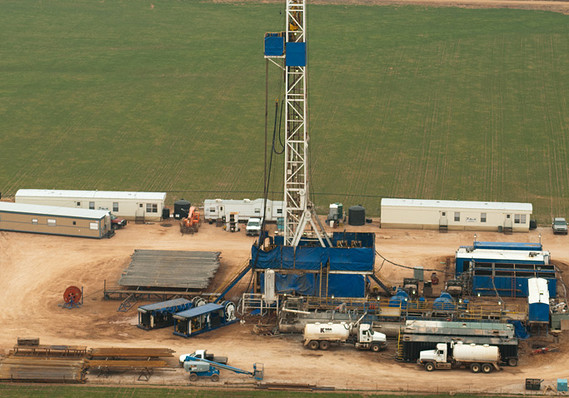

Oklahoma Farm Bureau applauds the Oklahoma legislature for passing HB 2562 Thursday, which reduces an approaching gross production tax rate increase on horizontal wells and also applies an equal rate to traditional vertical wells. Under the new law, horizontal wells will be subject to a tax incentive program to reduce the effective gross production rate to 2 percent for the first 36 months of production and then increase to 7 percent. The same law will be applied to vertical wells, which are currently taxed at 7 percent.

Oklahoma Farm Bureau applauds the Oklahoma legislature for passing HB 2562 Thursday, which reduces an approaching gross production tax rate increase on horizontal wells and also applies an equal rate to traditional vertical wells. Under the new law, horizontal wells will be subject to a tax incentive program to reduce the effective gross production rate to 2 percent for the first 36 months of production and then increase to 7 percent. The same law will be applied to vertical wells, which are currently taxed at 7 percent.

The bill replaces an expiring incentive program and prevents the gross production tax rate from automatically increasing to the actual rate of 7 percent in 2015.

"While we are always concerned about raising taxes on landowners, we view this bill as a strong compromise for our members who own mineral rights and the oil and gas companies who provide jobs and revenue in our rural communities," OKFB President Tom Buchanan said. "We would like to thank the legislature for taking action before royalty owners and the state's energy industry were negatively impacted next year."

The State Chamber of Commerce also released a statement expressing their agreement with the measure that will head to the Governor for her consideration.

"This compromise language provides certainty for one of the key industries in Oklahoma," said State Chamber President and CEO Fred Morgan. "It ensures that companies making their drilling plans this summer won't have to assume a sevenfold increase in taxes and provides fairness by treating all wells the same."

Without action this year, companies would have to assume that the tax rate on horizontal wells would increase from one-percent to seven-percent in July, 2015. That could have led to drilling operations being moved to more cost-competitive states, taking jobs, capital investment and royalty payments with them.

"We are happy lawmakers acted to ensure continued growth throughout Oklahoma's economy," said Morgan. "We'd like to thank Lieutenant Governor Todd Lamb, Speaker Jeff Hickman, President Pro Tem Brian Bingman and Senator Rob Johnson for carrying this bill through the legislative process."

WebReadyTM Powered by WireReady® NSI

Top Agricultural News

More Headlines...